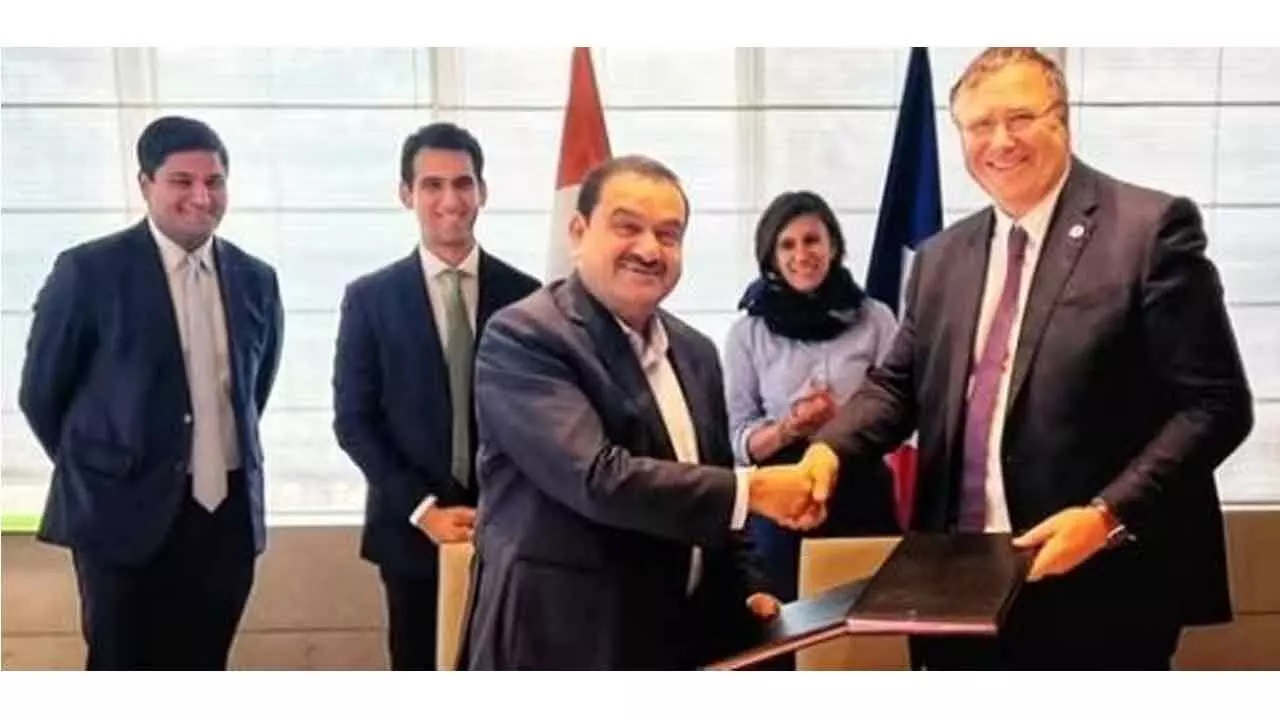

No Impact Of Total’s Decision: Adani

Total Energies on Monday said it paused fresh investments into Adani Group following US indictment

No Impact Of Total’s Decision: Adani

New Delhi: Embattled billionaire Gautam Adani’s group on Tuesday said French energy giant TotalEnergies’ decision to pause new investments in the group will not have any material impact on operations and growth plans as no new funding was under discussion.

TotalEnergies SE had on Monday stated that it was not aware of the corruption investigation its partner Adani group’s founder Chairman was facing in the US and that it is pausing fresh investments in the conglomerate pending the outcome of the charges.

“We wish to clarify that there is no new financial commitment under discussion with TotalEnergies,” Adani Green Energy Ltd (AGEL) said in a stock exchange filing. It was clarifying on TotalEnergies’ statement of November 25.

“Hence, the press release (through which the French firm announced its decision) will not have any material impact on the company’s operations or its growth plan,” AGEL added. TotalEnergies is one of the biggest foreign investors in Adani’s business empire and had previously taken stakes in the group’s renewable energy venture AGEL and city gas unit Adani Total Gas Ltd (ATGL).

In a statement on Monday, the French firm had said it learnt of US authorities indicting Gautam Adani and two other executives for allegedly paying $ 265 million bribes to Indian officials to secure solar power supply contracts for AGEL. “This indictment does not target AGEL itself, nor any AGEL-related companies,” TotalEnergies had said. “Until such time when the accusations against the Adani group individuals and their consequences have been clarified, TotalEnergies will not make any new financial contribution as part of its investments in the Adani group of companies.”

Adani group has dismissed the allegations brought in the US court as baseless and has said it would seek all possible legal recourse. TotalEnergies holds 19.75 per cent stake in AGEL - the renewable energy arm of the Indian group. It also has a 50 per cent stake in three joint venture companies that produce electricity from sunlight and wind with AGEL. The French firm also holds a 37.4 per cent stake in Adani Total Gas Ltd, which retails CNG to automobiles and pipes natural gas to households for cooking. TotalEnergies, France’s largest oil and gas company, first joined hands with Adani in 2018 for a liquefied natural gas (LNG) venture before buying a 19.75 per cent stake in AGEL and a stake in three solar assets for $ 2.5 billion in 2020-21.

The French energy giant had in February last year put on hold a planned investment in Adani Group’s $ 50 billion hydrogen project pending results of an audit launched following allegations by a US short-seller. While the partnership, where the French oil giant was to take a 25 per cent stake in the hydrogen venture of the Adani Group, was announced in June 2022, TotalEnergies had not yet signed a contract. As per the June 2022 announcement, TotalEnergies was to take 25 per cent equity in Adani New Industries Ltd (ANIL) – the Adani Group firm that is investing $ 50 billion over 10 years in a green hydrogen ecosystem, including an initial production capacity of 1 million tonne before 2030.

The announcement by Total adds to the woes of Adani. The crisis around the group, which began when Hindenburg released a damning report in January 2023, has also been used by the opposition parties to attack the government, alleging that the tycoon’s rise was primarily because of his association with Prime Minister Narendra Modi. The government has rejected the allegation.

Hindenburg’s allegations of accounting and financial fraud unleashed an over $ 150 billion rout in market value across Adani’s companies. Adani Group has vehemently denied the allegations, calling them malicious and an “attack on India”. The group stocks had recovered most of the losses before last week’s indictment in a New York court.